Effective Negotiation Strategies for Today's Boston Condo Market

Have you heard? Boston condo buyers are starting to gain some negotiating leverage in today's housing market shift. While it's not quite a buyer's market yet, it does mean there's room for more favorable terms. Sellers need to be prepared for these negotiations and understand their boundaries in thi

Navigating Boston Real Estate: Your March 2023 Market Analysis

As we continue to keep a close eye on Boston's real estate market, we'd like to share the latest trends and insights for March 2023. Understanding these changes is essential in making informed decisions, whether you're planning to buy, sell, or invest in the area. Experiencing a Dip in Months Supply

Categories

Recent Posts

The Most Important Things You Should Do to Prep Your Condo for the Market

10 Proven Strategies to Sell Your Boston Home Faster Without Slashing the Price

Boston Housing Market: How Historical Trends Shape Modern Real Estate

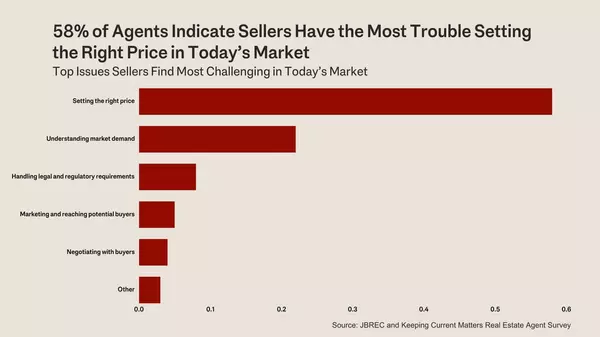

Price It Right: Why Getting the Price Right is Crucial in Today’s Market

Selling Your Boston Home? Avoid the #1 Mistake: Overpricing

Effective Negotiation Strategies for Today's Boston Condo Market

Elevating Your Urban Sanctuary: Budget-Conscious Enhancements for Condo Living

A Slice of Serenity in the Heart of Boston: A Closer Look at 1427 Commonwealth Ave #103

Why the Median Home Price is Meaningless in Today's Market

Luxury Living with Stunning City Views: A Look at 150 Dorchester Ave #514 in South Boston